Swing Trading: 5 Tips and Techniques for Minimizing Risk and Maximizing Returns

- Develop a solid trading plan

- Use technical analysis tools

- Keep an eye on news events and economic data

- Focus on trading liquid stocks

- Maintain a disciplined approach to trading

We previously discussed position trading in one of our blog posts since it aligns with our current trading strategy. Additionally, in a previous post, we mentioned that we tested the tips and strategies on online trading we shared by executing two buy orders of 10 shares each for Aboitiz Equity Ventures, Inc. (AEV). However, we realized that we could try some swing trading on the side to expand our trading skills.

1. Develop a solid trading plan

Develop a solid trading plan that includes clear entry and exit strategies, risk management techniques, and position sizing.

The article by Alan Farly reviewed by Gordon Scott and fact-checked by Timothy Li in Investopedia.com highlights the importance of choosing a holding period that aligns with your trading strategy. It explains that the holding period depends on the type of trading strategy we choose:

- Day Trading: Minutes to Hours

- Swing Trading: Hours to Days

- Position Trading: Days to Weeks

- Investment Timing: Weeks to Months

The article also emphasized the importance of sticking to the parameters of your chosen strategy to avoid turning a trade into an investment or a momentum play into a scalp. The approach requires discipline, but taking your exit within the parameters builds confidence, profitability, and trading skill.

Additionally, before entering a trade, he also recommended establishing reward and risk targets. This can be done by identifying the next resistance level on the chart within your holding period as your reward target and determining the price at which you will exit the trade if proven wrong as your risk target. To ensure a profitable trade, aim for a reward/risk ratio of at least 2:1. If the ratio is less than that, it is advisable to skip the trade and look for better opportunities.

We tested this strategy in relation to our post about online trading tips and strategies -- although not so perfectly because our priority is to experience our first round trip -- with one of our trades this week. Here is the result:

- Stock: Aboitiz Equity Ventures, Inc. (AEV)

- No. of shares: 320

- Resistance Level: Php62.00 assumed to be the Reward Target

- Support Level: Php47.50 assumed to be the Risk Target

- We consider 75% x (Reward Target less Risk Target) Value for our profit protection strategy.

- Entry on March 28, 2023, at Php51.20 per share

- Exit on March 30, 2023, at Php51.95 per share

- PROTECTED REWARD TARGET (58.40) - RISK TARGET (47.50) = 10.90

- REWARD = REWARD TARGET (58.40) - ENTRY (51.20) = 7.20

- RISK = ENTRY (51.20) - RISK TARGET (47.50) = 3.70

- PLANNED REWARD/RISK RATIO = 1.95

- ACTUAL REWARD/RISK RATIO = 0.20

We can also analyze our results from another point of view. We are going to use the data obtained from COL Financial Philippine Equity Research Technical Guide as of March 28, 2023, with the AEV recommendation of "sell into strength" initiated on March 21, 20023:

- 52-Week High: Php61.95 assumed to be the Reward Target

- 52-Week Low: Php44.85 assumed to be the Risk Target

- We consider 75% x (Reward Target less Risk Target) Value for our profit protection strategy.

- Entry on March 28, 2023, at Php51.20 per share

- Exit on March 30, 2023, at Php51.95 per share

- PROTECTED REWARD TARGET (57.70) - RISK TARGET (44.85) = 12.85

- REWARD = REWARD TARGET (57.70) - ENTRY (51.20) = 6.50

- RISK = ENTRY (51.20) - RISK TARGET (44.85) = 6.35

- PLANNED REWARD/RISK RATIO = 1.02

- ACTUAL REWARD/RISK RATIO = 0.12

Our exit point should have been in the range of Php57.70 to Php58.40, according to this strategy. And we could also improve the reward/risk ratio by increasing our risk target to Php47.60. Better if we entered the market at Php49.10.

Learnings: If you approach swing trading but then choose to exit at the price point of a day trader, you risk a situation where your position falls far below your reward target. Even if you have a profit protection stop in place, it won't do any good if you don't use it.

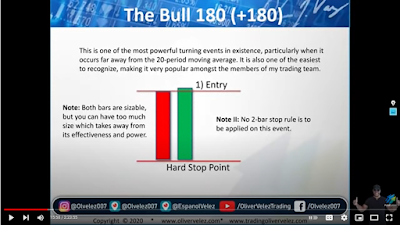

2. Use technical analysis tools

Use technical analysis tools to identify potential swing trading opportunities and set up price alerts to monitor the market.

3. Keep an eye on news events and economic data

Keep an eye on news events and economic data releases that could impact the market and your trades.

4. Focus on trading liquid stocks

Focus on trading liquid stocks with high trading volumes and narrow bid-ask spreads to minimize slippage and maximize efficiency.

5. Maintain a disciplined approach to trading

Maintain a disciplined approach to trading by avoiding emotional decision-making, sticking to your trading plan, and continuously reviewing and adjusting your strategies as needed.

Lessons Learned

Swing trading is a popular investment approach that involves buying and holding an asset for a brief period, typically a few days to a few weeks, with the aim of profiting from market swings.

To identify trading opportunities, swing traders rely on technical analysis to detect patterns in trading activity and capitalize on momentum trends. They usually focus on large-cap stocks that are heavily traded.

However, swing trading comes with various risks, including gap risk, which refers to price changes that occur while the market is closed.

Successful swing traders must manage risk by choosing only liquid stocks and diversifying their positions across different sectors and capitalizations.

We highly recommend an informative article on minimizing risks in swing trading authored by Rebecca Baldridge and edited by Jasmine Suarez for Business Insider. As beginners, we found the article to be particularly helpful in gaining a deeper understanding of swing trading. We acknowledge the author and editor for their insightful contribution and suggest that readers interested in learning more about swing trading should check out the article for additional details.

In addition, the website www.schwab.com published an article titled Swing Trading Strategies that compared swing trading with day trading and long-term position trading. The article describes swing trading as a strategy that lies between day trading and long-term position trading. It explains that position traders may hold a position for weeks to months, while swing traders are likely to trade on smaller swings within a shorter period.

The important lesson we can learn from this is that swing trading can be a profitable investment approach, but it comes with risks that must be managed through careful stock selection, diversification, and a focus on liquidity. It also requires reliance on technical analysis to identify trading opportunities and capitalize on momentum trends.

Watch out for more posts on swing trading!

No comments:

Post a Comment