Putting Our Experience to the Test: 7 Best Trading Tips and Strategies

- Identify key support and resistance levels

- Use multiple time frames to confirm patterns

- Look for patterns with a high probability of success

- Combine chart patterns with other indicators

- Always have a plan for entry and exit before making a trade

- Use stop-loss orders to limit potential losses

- Keep an eye on volume for confirmation of a breakout or breakdown

#1 Identify key support and resistance levels

Support and resistance are two foundational concepts in technical analysis, says Investopedia.com. It offers a very good introduction to these concepts, and you may want to read the article Support and Resistance Basics (investopedia.com) by Casey Murphy for more information.

Support is the price level where demand equals or surpasses supply, causing the price decline to halt and reverse. Resistance is the opposite of support, where selling overwhelms the desire to buy, and prices stop rising.

These levels can serve as entry or exit points for traders, and their timing is based on the belief that these zones will not be broken. Traders can bet on the direction of the price and quickly determine if they are correct based on price movement respecting or breaking prior support or resistance levels.

Testing for Experience:

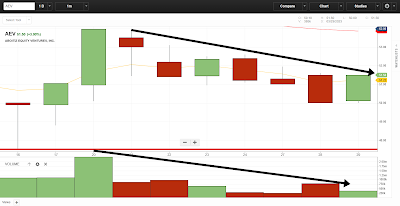

We have identified the Aboitiz Equity Ventures, Inc. (AEV) stock in our portfolio and checked for its daily closing prices over 1 year from March 28, 2023, when it closed at Php 50.00 for the day.

Analysis:

Upon analyzing the chart with a one-year timeframe (200 trading days), we have visually determined that AEV's support level is most likely at Php47.50, while the resistance level is at Php62.00.

#2 Use multiple time frames to confirm patterns

Time frames refer to the duration of a trend in the market. Traders should use multiple time frames to identify and confirm trends and refine their trading entries and exits.

Primary time frames are actionable in the short term, while other time frames can range from minutes or hours to days or weeks. Traders should use a longer time frame to define the primary trend, a preferred time frame to define the intermediate trend, and a faster time frame to define the short-term trend.

Using multiple time frames allows traders to better understand the trend and make more confident decisions. This is according to the article Multiple Time Frames Can Multiply Returns (investopedia.com) by Joey Fundora.

Testing for Experience:

Hence, to gain a deeper perspective on the levels we identified in Tip and Strategy #1, we used the following time frames to further refine our strategy:

- Primary time frame : 200 days for long-term trend

- Intermediate time frame : 50 days for our preferred medium-term trend

- Short-term time frame : 6 days for our actionable short-term trend

Analysis:

Based on the time frames we are currently using, our trading style, for now, is definitely not scalping, day trading, or swing trading. We are in a long-term position trading while building up our stock portfolio.

#3 Look for patterns with a high probability of success

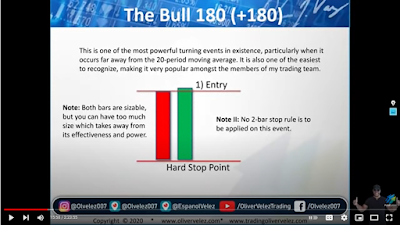

In the article 4 Day Trading Patterns Every Day Trader Should Know (admiralmarkets.com) by Jitanchandra Solanki, he discussed four trading patterns that traders can use across multiple markets such as stocks, forex, indices, and commodities.

The ascending triangle and descending triangle patterns show periods of consolidation after an upward or downward move before it continues to move higher or lower, respectively. The bullish and bearish head and shoulders patterns form when a large trough or peak develops at a horizontal resistance or support line and two smaller troughs or peaks form on either side of it.

Each pattern can give a trader more understanding of what is happening in the market, but no chart pattern works all the time. Therefore, it is crucial to incorporate other forms of technical analysis and proper risk management tools together.

We mentioned day trading in advance because it is one of the trading styles we shall be learning by doing in our future online trading activities.

Meanwhile, for our long-term position trading approach, we highly recommend the YouTube tutorial COL Financial Basic Charting: Moving Average & Trend Following Strategy by Omeng Tawid - Smart Pinoy Investor for those looking to learn about stock charting. The video provides a comprehensive introduction to charting in COL Financial and covers the concept of a stock's moving average, demonstrating how it can be utilized to increase profits from trending stocks.

Testing for Experience:

Analysis:

After conducting our analysis, we have found that AEV has been in some form of consolidation phase over the past few months. However, in recent weeks, the bears have gained more control over the market compared to the bulls. In other words, sellers have been more active than buyers in the market for AEV in the past few weeks.

#4 Combine chart patterns with other indicators

The article A Useful Guide to Combine Candlesticks with Indicators (brokerxplorer.com) by Diva Nadia provides a guide to combining candlestick patterns with indicators to improve trading accuracy. It highlights that candlestick patterns should not be viewed in isolation but should be seen in the right price action context.

Combining candlestick patterns with other indicators such as moving averages and oscillators can help confirm trends and make better predictions. The article provides a step-by-step guide on how to use moving averages to analyze price movements and the current market trend. It also discusses how combining candlestick patterns with oscillators, such as the MACD, can help capture short-term reversals and momentum.

Testing for Experience:

To gain further insight into AEV's performance, we utilized a combination of Tips and Strategies #1, #2, and #3. This involved plotting the Exponential Moving Averages (EMA) as our primary indicator, along with the candlestick chart covering the stock's 3-month historical closing prices.

In general, according to Omeng Tawid - Smart Pinoy Investor:

- when the stock price is above your 200-day EMA, it's a good sign of a healthy trend.

- when the stock price is below your 200-day EMA, it's not a good sign.

Analysis:

According to our analysis, AEV has been trading below both its 200-day and 50-day EMAs for the past 35 days since February 21, 2023. As a result, these EMAs have become the resistance levels for the stock. Additionally, the 6-day EMA has been trending downwards, supporting our conclusion that AEV's stock is currently in a downtrend, as stated in Tip and Strategy #3.

#5 Always have a plan for entry and exit before making a trade

The next strategy involves creating our entry and exit plan using the Tips and Strategies we have discussed. This is where things start to get exciting.

Testing for Experience:

Trading Style: Long-term position trading

Stock: Aboitiz Equity Ventures, Inc. (AEV)

Support: Php47.50

Resistance: Php62.00

Target Price: Php61.00

Trading Rules:

- Rule 1: We use the long-term trend filter. The close must be higher than the close 200 days ago.

- Rule 2: We use the medium trend filter. The close must be higher than the close 50 days ago.

- Rule 3: We use a short-term trend filter. The close today must be a 6-day low (of the close).

- Rule 4: If Rule 1-3 is true, then we go long at the close and BUY.

- Rule 5: We use the short-term pullback and SELL at the close when the close is higher than our target price.

Analysis:

We executed two buy orders for the AEV stock these past 2 weeks, optimizing the available trading fund we have at our COL Financial Trading account.

1st Buy Order on March 22, 2023, for 10 shares at 52.95 per share with a Net Amount of Php551.98 including transaction cost.

2nd Buy Order on March 23, 2023, for 10 shares at 51.45 per share with a Net Amount of Php536.98 including transaction cost.

Past 2 buy transactions evaluated:

- 1st buy order entry point on March 22 evaluated

- 200-day EMA is 55.30: Rule 1 is false

- 50-day EMA is 54.46: Rule 2 is false

- 6-day EMA is 51.88: Rule 3 is false

- Our trading rules demand that we stay on the sidelines and hold on to cash.

- We entered the market in violation of Trading Rule 4.

- 2nd buy order entry point on March 23 evaluatedc

- 200-day EMA is 55.27: Rule 1 is false

- 50-day EMA is 54.37: Rule 1 is false

- 6-day EMA is 51.99: Rule 1 is false

- Trading rules demand we stay on the sidelines and hold on to cash.

- We entered the market at 51.45 in violation of Trading Rules 4.

#6 Use stop-loss orders to limit potential losses

We find the article Why we need to learn how to cut losses (inquirer.net) by COL Financial First Vice President & Chief Equity Strategist April Lynn Tan very much explains the use of stop-loss orders. In summary, the article explained that cutting losses when investing is important for several reasons. Firstly, the company's fundamentals may have changed, affecting its profitability. Secondly, freeing up capital from losing stocks can enable investing in more promising opportunities. Thirdly, cutting losses can have a psychological benefit, helping to avoid becoming overly risk-averse and hesitant to invest.

It is important to plan ahead, resist the temptation to invest in speculative tips, and assess honestly why a losing stock was purchased. The decision to sell should not be based on the size of the loss alone, and investors should be mentally prepared to move on to more promising investments.

Testing for Experience:

We are setting our stop-loss order at Php47.50 support price we determined in Tip and Strategy #1 just in case.Analysis:

We believe that our stop-loss threshold of Php47.50 is reasonable as its impact may lead to an actual loss of maybe about 10% to 15%.

#7 Keep an eye on volume for confirmation of a breakout or breakdown

Technical analysis relies on trading volume as a market indicator to evaluate and confirm or contradict a trend, as explained in the article Trading Volume as a Market Indicator published on www.schwab.com.

Above-average and/or increasing trading volume can indicate strong enthusiasm for a price move, while below-average and/or decreasing volume can indicate a lack of enthusiasm.

Bullish signals include an upside breakout with above-average volume and an uptrend accompanied by increasing volume, while bearish signals include a downside breakout accompanied by heavy volume and a downtrend accompanied by increasing volume.

Traders who use volume analysis may watch for signs of a pickup supported by increasing volume to confirm a trend. As a rule of thumb, any price breakout or trend that is accompanied by above-average volume could be considered more significant than price movements that are not.

Testing for Experience:

We prepared the chart of Aboitiz Equity Ventures, Inc (AEV) stock for the period March 15 to 29, 2023 showing trade volume using the charting feature of the COL Financial trading platform.

Analysis:

As someone who invested in AEV stock on March 22 and 23, 2023, it is worth noting that a downtrend with decreasing volume indicates limited investor concern. Although the stock's price may still decline, traders who use volume analysis may begin monitoring the stock for any indications of a turnaround, backed by increasing volume.

Trading statistics

In the meantime, we plan to conduct a live online trading experiment to further test the effectiveness of the 7 tips and strategies presented in this post. We will keep you updated on our progress and share the results with you. To measure our success, we will be utilizing the following trading statistics:

- Number of trades: 25-50

- Average gain per trade: 0.25% to 0.30%

- Win rate: 70% to 80%

- Max drawdown: -10 to -15%

In conclusion, as we continue to develop and refine our investment strategy, we value the input and feedback of our stakeholders. We believe that collaboration and open communication are critical in achieving our shared goal of maximizing returns while managing risk. If you have any suggestions on how we can further improve our strategy, we encourage you to get in touch with us and share your ideas. Your insights and perspectives are valuable to us, and we are committed to listening to and incorporating your feedback into our decision-making process. Together, let us work towards achieving our financial goals and aspirations.

No comments:

Post a Comment